Good Morning,

Welcome to Padder’s weekly real estate news. A newsletter for brokers, mortgage agents, operators & investors. Want to wake up to the best weekly real estate brief in Canada? Become one of our 1,000+ subscribers by clicking below.

Market Highlights

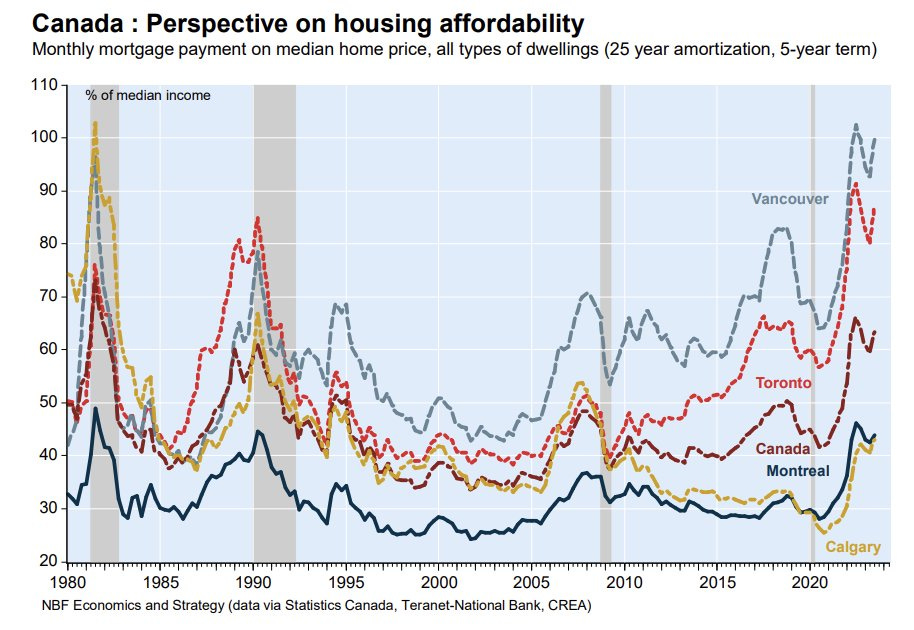

National Bank’s Housing Affordability monitor illustrates a massive retreat in affordability of housing in Canada, based on Mortgage Payment as Percentage of Income.

Stat central

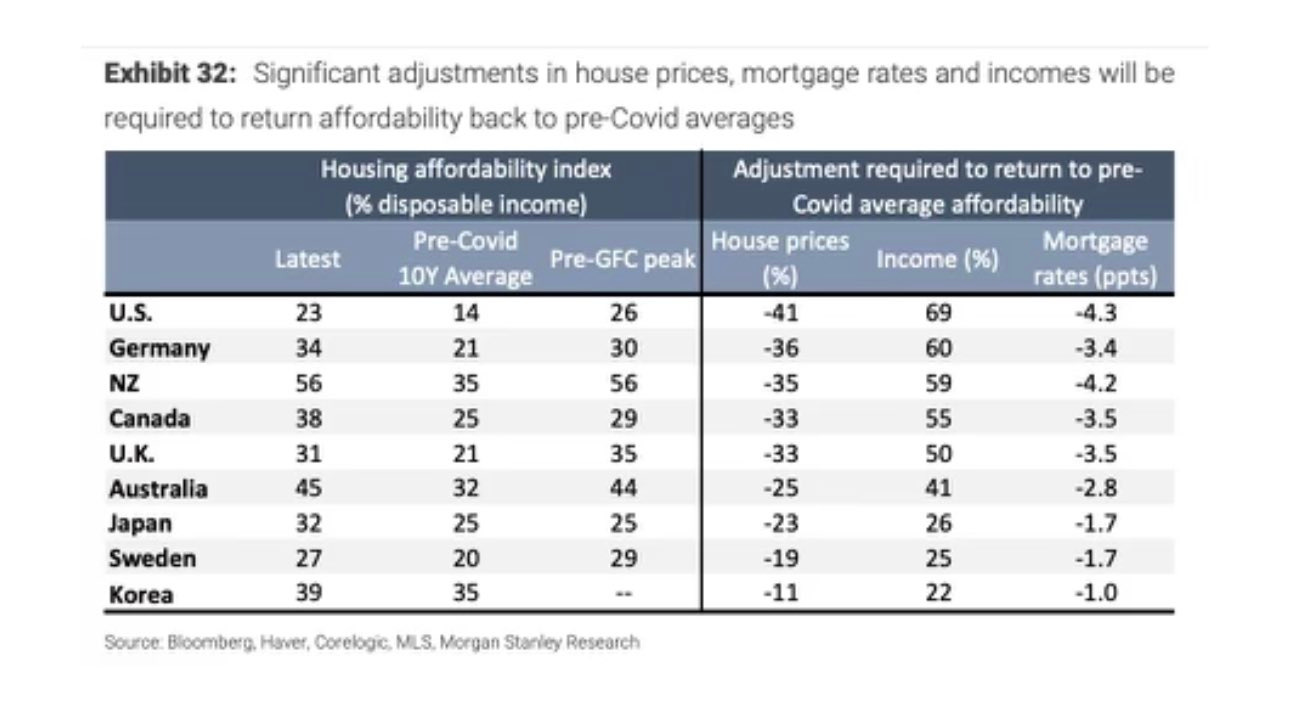

As a reminder, Bloomberg suggests that in order for Canadian housing affordability to return to pre-pandemic levels, we’d need to see some combination of:

🏠 -33%

The amount house prices would need to fall in order for Canadian housing to reach pre-pandemic affordability levels, if all other variables remained equal.

💸 +55%

The amount incomes would need to rise for housing affordability to reach pre-pandemic affordability levels, if all other variables remained equal.

📉 -350bps

The amount mortgage rates would need to fall for housing affordability to reach pre-pandemic affordability levels, if all other variables remained equal.

Headlines

New standardized designs will help build more homes quicker

Homeowners and builders will soon be able to develop new housing quicker and with less cost as the Province works to create new standardized designs for small-scale, multi-unit homes, such as townhomes, triplexes and laneway homes.

‘Bank of Mom and Dad’: StatCan report shows home ownership runs in the family

Within this group, StatCan found that the adult children of non-homeowners had a home ownership rate of 8.1 per cent as of 2021. But for those whose parents were homeowners, the ownership rate rose to 17.4 per cent. If a parent owned multiple properties, the odds of their children owning a home rose to 23.1 per cent — nearly triple the odds of kids without home-owning parents.

National Housing Day: A Cheat Sheet For The State Of Housing In Canada

Tuesday, November 22, was National Housing Day in Canada. Recognized each year by all levels of government, it's intended to highlight the work of housing providers who are improving access to safe and affordable housing for Canadians. Storeys complies the highlights from some of their recent best articles to shed some insight and perspective on the state of the Canadian housing.

Tweets & Charts

What we’re reading

The North America Family Office Report 2023

Family offices continue to evolve and seek innovative ways to navigate an uncertain environment. The 2023 North America Family Office Report explores this journey by examining 144 family offices across Canada and the United States, offering comparisons to global peers.

Still Renovating: A History of Canadian Social Housing Policy

Greg Suttor tells the story of the rise and fall of Canadian social housing policy. Focusing on the main turning points through the past seven decades, and the forces that shaped policy, this volume makes new use of archival sources and interviews, pays particular attention to institutional momentum, and describes key housing programs.

Want your brand or deal in front of real estate professionals? Reply to this email to learn more.

Catch ya next week!

-Padder